Here’s a detailed guide to get your tax identification number.

In this guide, I’m going to work you through the same processes I followed to get a Taxpayer Identification Number (TIN).

You will learn about everything you need to know, the required documents, how long it took me to get the number and the best place to apply for the TIN.

But, before we dive in, let’s step back to the beginning.

Recommended For You: Learn everything you need to know about applying for the Tony Elumelu Entrepreneurship Programme, writing a stand out proposal, and winning the $5,000 grant. We even included a TEEP application checklist to help you stay on track. Start Your Journey Now

You Might Also Like: The Top 15 Small Business Challenges and How to Navigate Them

Table of Contents

Key Takeaways (Editor’s Picks)

- A Tax Identification Number (TIN) is a crucial identifier for corporations and individuals in Nigeria engaged in economic activities

- Verify your Tax Identification number using the JTB TIN verification portal to confirm its accuracy.

- You can use your TIN for all types of taxes

- Regularly update your TIN to ensure it reflects accurate information, especially if you have incomplete records.

- Report suspicious activity or TIN-related issues to the FIRS

What exactly is TIN?

The Taxpayer Identification Number is a unique number that is assigned to duly registered individuals and companies which identifies them as taxpayers in Nigeria.

Who Needs TIN In Nigeria?

Anyone in Nigeria engaged in economic or financial activities needs a TIN.

Individuals that fall under this category include:

- Employees or self-employed individuals

- Sole proprietary businesses, partnerships, limited liability companies, or public limited companies

- NGOs, charities, religious organizations, or cooperative societies

- Any other entity that is liable to pay tax or required to file tax returns

Why do you need TIN?

For one, the Nigerian law mandates individuals and businesses to file their tax returns. The taxpayer identification number is the only way to link your tax payments to you since you will have to quote the digits in all your tax-related transactions.

Other reasons why you need to get your TIN include:

- If you are chasing a government contract

- You want to obtain a loan from financial houses

- You’re opening a corporate bank account

- You want to register a vehicle

- To obtain a certificate of occupancy

You may also like: How the FG’s New Finance bill Will Affect Your Business

How much will it cost to get a TIN?

It is free to apply for a TIN. You don’t have to pay any fees when applying for a TIN by yourself.

Is there a difference between JTB and FIRS TIN?

The Joint Tax Board (JTB) TIN is a 10-digit tax identifier which is designed to replace the FIRS TIN. It is uniform, unique and not limited to only FIRS taxpayers.

Recommended For You: Steady Streams Of Organic Leads to Grow Your Business

How to get your Tax Identification Number as an individual

If you are a non-corporate taxpayer, here are the steps to obtain your TIN.

According to the JTB:

Individuals are automatically assigned with a TIN based on their BVN (Bank Verification Number) or NIN (National Identity Number). To get a TIN as an individual, you need to have a NIN or BVN.

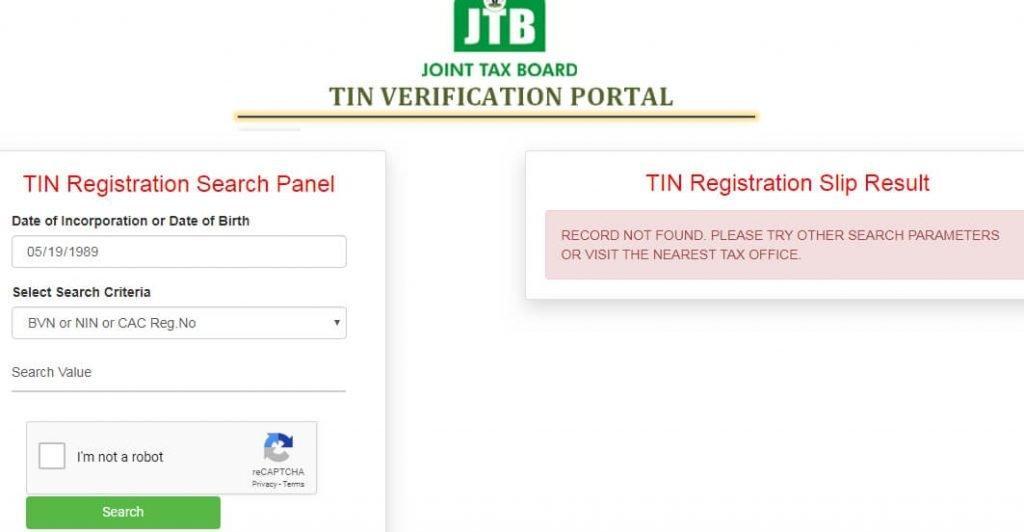

To verify your individual TIN, use this link >> Verify

Then, follow the steps below:

- Step 1: Select your Date of Birth.

- Step 2: Select your preferred search criteria from the Select Criteria Dropdown–TIN or NIN or BVN or Registered Phone Number

- Step 3: Provide the appropriate value based on the search criteria in Step 2 above

- Step 4. Confirm you are not a robot by checking the reCAPTCHA Box

- Step 5: Click the Search button

Side Note: When I tried to verify my Individual TIN, it showed record not found. See the image below, so you may experience the same issue too.

How to get your Tax Identification Number in Nigeria Online

If you are a corporate taxpayer, there are two ways to get a TIN – you can either visit the nearest FIRS office or use the online portal to request for a tax identification number.

In this section, I’ll work you through the process of requesting for a TIN online.

Step 1: Visit Apply for TIN

Step 2: Under the Non-Individual heading you will see a link. Click on it. Or use this link to go directly to the request form. Form

Step 3: Fill out the form. The fields with the * asterisks are compulsory. Be sure to complete the form with accurate information about your business.

Step 4: Hit the ‘Submit’ to request for a TIN

The TIN takes up to 48 hours to generate. So you may want to check the functional email address you provided for your TIN details.

You may also decide to request fort the TIN offline. In which case, you will have to visit the nearest FIRS office.

Keep in mind though, it might take up to 5 days to get the TIN when you apply offline.

Recommended For You: Free Business Templates to Streamline Your Workflow

How to Apply for a Company TIN In Nigeria

Business TIN application is slightly trickier than when applying as an individual because you’re required to provide more information and documents.

But don’t worry; we’ll guide you through the company tax identification number application process.

We’ll start with who is eligible for a company TIN in Nigeria.

Who is Eligible for Company TIN in Nigeria?

Non-individual taxpayers are eligible for a company tax identification number in Nigeria.

Individuals under this category include business and corporate ventures.

As long as you’re not applying for your personal TIN, you fall under this category.

Let’s move on to the requirements for your corporate TiN.

Requirements for Company TIN in Nigeria

Here are the requirements to apply for a TIN if you’re a non-individual taxpayer:

- A duly completed VAT Form 001 and INPUT form

- An application letter for VAT/TIN registration typed on company letterhead and addressed to the nearest FIRS office

- Original certification of registration (Business name, incorporation) and other relevant documents for sighting

- Photocopies of certification of registration and other related documents

- Means of identification such as a Valid Driver’s license, National ID card, or International passport

- A Utility bill (Original and photocopy)

- An email address (preferably your company’s)

With these, you can begin your TIN registration process.

Company TIN Application Process

- Visit tin.jtb.gov.ng.

- Select “Register for TIN (non-individuals).”

- Choose your organization type.

- Input your business registration name and number.

- Complete the form by inputting the remaining details.

- Click on submit.

Note: Always ensure you’re providing the correct information to avoid complications.

Also, the sections marked asterisk (*) are compulsory. So, you must provide the requested information in those sections.

Your TIN details will be sent to the functional email address you provided within 48 hours of generating your tax identification number.

How to Get a TIN Offline

If you’re looking to obtain your TIN, but can’t follow the online process or prefer going to a physical location, then you should consider getting an offline registration.

This process involves going to a certified TIN registration center for the process.

The only difference between the offline and online application process is the procedures.

You’re still getting a verified tax identification number regardless of your application process.

Where to Apply for Your TIN Offline in Nigeria

To apply for your TIN offline in Nigeria, visit the nearest FIRS office with the required documents (same documents as with the online process).

If you don’t know the closest Federal Inland Revenue Service office around you, visit the FIRS office locator web page to find one in your vicinity.

Online TIN application has its advantages and disadvantages, and so does applying offline.

Applying online is faster, more convenient, and can be done from the comfort of your home.

However, it could be a complicated process for people unfamiliar with the online space.

In such situations, an offline registration might be preferable.

However, that, too, has its advantages and disadvantages.

Advantages of Applying for TIN offline

The advantages of applying for TIN offline are:

- You’re attended to by certified personnel who understand the system, thus minimizing the margin for error.

- Offline application is an alternative for individuals who are not familiar with online processes

- You can have your related questions and inquiries resolved immediately as opposed to scouring the internet for answers.

Disadvantages of Applying for TIN Offline

- Paperwork can be cumbersome compared to the online process.

- It might require you to travel long distances to a registration center if one isn’t around the corner

- It takes longer to receive your TIN, unlike the online process which can take only a few minutes.

Common Challenges During TIN Application

The TIN application process can sometimes be complicated, especially when encountering challenges.

In this section, we’ll cover some common challenges you’ll likely face whether you’re applying offline or online.

They are:

The process of applying for a Tax Identification Number (TIN) can be challenging. Some common challenges include:

- Lack of proper documentation: This happens when you don’t have all the required documents, such as a valid ID card, passport, or driver’s license.

- Inadequate information: You may not have sufficient information about the application process, such as the required forms and fees.

- Technical difficulties: Technical issues can hinder the online application process. They include slow internet speed or website downtime

- Processing delays: The processing of TIN applications can take a long time, especially in high-demand periods.

- Application errors: Errors in filling out the application form can lead to rejection or delay in processing.

Don’t worry. You can avoid these challenges by seeking assistance from a tax professional or contacting the relevant tax authority for guidance.

Also, some tax authorities may offer online resources to help applicants during the application process.

TIN registration requirements

When applying for the TIN, be sure to keep the following documents within reach:

- A duly completed VAT Form 001 – to be filled by the Taxpayer

- A duly completed INPUT form – to be filled by the Taxpayer

- An application letter for VAT/TIN registration. It should be typed on company letterhead and addressed to the nearest FIRS office.

- Original certification of registration (Business name, incorporation) and other relevant documents for sighting.

- Photocopies of certification of registration and other relevant documents

- Means of identification ( National ID card, Valid Driver’s license or International passport)

- Utility bill (Original and photocopy)

- A functional email address

How to Verify Your Tax Identification Number

So, you’ve gotten your Tax Identification Number—well done!

Now, it’s time to verify your TIN.

Don’t worry. The JTB TIN verification process isn’t as tedious as the application process.

Just follow these steps:

- Visit the joint tax board TIN registration portal

- Click “TIN verification panel

- Input your date of birth or company incorporation if you apply for your business TIN.

- Under “Select Search Criteria,” choose Tax Identification Number.

- Input your TIN underneath.

- Check the reCAPTCHA box underneath to confirm you’re not a robot.

- Click on “search.”

That’s all!

TIN Protection Best Practices

Tax Identification Number (TIN) is a unique identifier assigned to businesses and individuals for tax purposes.

Hence, you must carefully use and protect your TIN to avoid fraud, identity theft, and other financial crimes.

Also, you might eventually need to update your TIN in the event of changes in the required information.

This section will guide you through these processes we just mentioned, starting with how to update your TIN.

How to Update Your TIN

Updating your TIN might be required if you’re a taxpayer with incomplete records with the Federal Inland Revenue Service (FIRS).

In such situations, we recommend providing additional information at the Tax Office where your TIN was initially generated.

If you registered for your tax ID number online, you might want to visit the nearest tax office to update your information.

How to Protect Your TIN

To protect your Taxpayer Identification Number (TIN), you should take the following measures:

Keep your TIN confidential: Avoid sharing your TIN with anyone unless it is necessary for tax purposes.

Secure your TIN documents: Keep your TIN documents in a safe and secure place to prevent them from falling into unauthorized hands.

Verify the validity of requests: Verify the identity of anyone who requests your TIN information before sharing it.

Monitor your credit report: We recommend regularly monitoring your credit report to detect any fraudulent activity that may be associated with your TIN.

Report suspicious activity: If you suspect that someone has missed or stolen your TIN, report it immediately to the FIRS.

Here are some ways to do so:

- Click this link to the FIRS “Contact Us” page, and leave a message stating that your JTB TIN certificate has been stolen or used for fraudulent purposes.

- Call the FIRS provided lines: 09074444441, 09074444442, 09072111111

- Send an email to complaints@firs.gov.ng

- Visit the nearest tax office for guidance

FAQs

What is JTB TIN?

JTB TIN is a tax identification number issued by the Nigerian Joint Tax Board. It is a unique 10-digit number for identifying, tracking, and taxing businesses, companies, and individuals in the country.

You can pay any type of tax with your JTB TIN since it’s universal.

What is the Difference Between FIRS TIN and JTB TIN?

The key difference between FIRS TIN and JTB TIN is that:

- JTB TIN is a Joint Tax Board-issued TIN for personal income tax, withholding tax on individuals, and stamp duties on individuals.

- FIRS TIN is issued by the Federal Inland Revenue Service for all types of taxes, such as companies’ income tax, value-added tax, petroleum profits tax, etc.

Both TINs are unique 10-digit numbers used to identify, track, and tax Nigerian companies, businesses, and individuals.

However, the Joint Tax Board (JTB) created the JTB TIN to replace FIRS TIN and unify tax processes.

How Long Does it Take to Get TIN in Nigeria?

When applying online, you can receive your Taxpayer’s identification number instantly or within hours.

While offline, it usually takes longer.

Keep in mind that the time frame might increase depending on the level of demand within the period of your registration.

What is a JTB Form?

A Joint Tax Board registration Form is the document you complete when registering for a JTB TIN in Nigeria.

This document contains your personal and business details, such as name, address, phone number, email, nature of business, etc.

It also requires the applicant’s signature and stamp or their authorized representative’s for TIN validation.

How to Check TIN Number on Phone

To check your Taxpayer Identification Number (TIN) in Nigeria, you can use the FIRS TIN Verification System.

Here are the steps to follow:

- Visit the FIRS TIN Verification System Website.

- Select “Phone Number” from the “Select Search Criteria” dropdown list.

- Enter your phone number in the “Search value” field.

- Click on the “Search” button.

Wrapping up: A detailed guide to get your tax identification number

We hope this guide will help you start and complete the process of obtaining a Tax Identification Number.

Have any questions or need help with your TIN application? Leave a comment below or use the Contact us form and we’ll get back to you as soon as we can.

Recommended For You: 10 Available Business Grants In Nigeria to Expand Your Business

Hand-Picked For You:

- FAQs: How to Start a Business In 2022

- FAQs: How to Grow Your Business In 2022

- FAQs: How to Fund Your Business In 2022