Nigeria’s federal government is making sweeping changes to the country’s tax laws. Here’s how FG’s new finance bill 2019 will affect your business and how you can prepare for the impending changes.

If you haven’t heard, Nigeria’s National Assembly on Nov.21 passed a new finance bill that when signed into law by the President will make sweeping changes to the country’s tax laws.

The bill, according to the finance minister, Mrs Zainab Ahmed will come into effect on January 2nd, as the President is expected to assent to the bill soon.

The new tax law is expected to make sweeping changes to the nation’s tax laws plus give the federal government additional powers, as it seeks to shore up its tax base.

Recommended For You: Learn everything you need to know about applying for the Tony Elumelu Entrepreneurship Programme, writing a stand out proposal, and winning the $5,000 grant. We even included a TEEP application checklist to help you stay on track. Start Your Journey Now

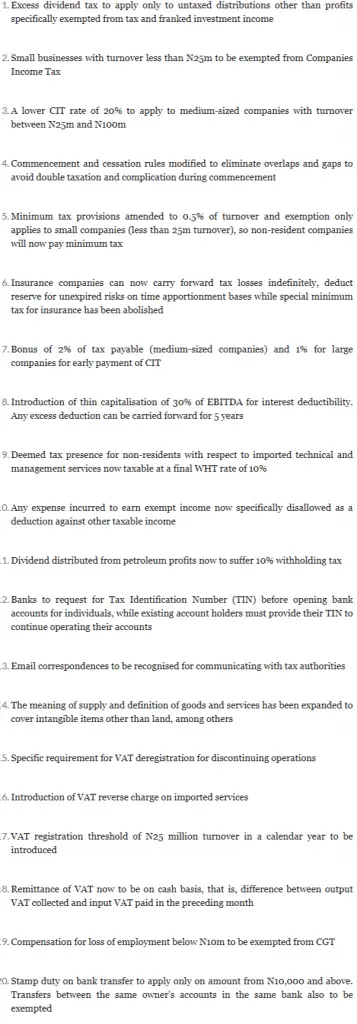

Here are some of the changes you should know about:

How the new finance bill will affect your business

The new bill when signed into law will make changes to aspects of the existing company income tax (CIT), personal income tax, Value added tax (VAT), Capital gains tax, stamp duties and Customs and Excise tariffs.

We published an earlier article about the new VAT changes, how it will impact businesses and what to expect. Use the link below to read up on it:

FIRS to Impose 5% VAT on Online Transactions

No more NGN50 charges on PoS Transactions less than NGN10,000

When the new tax law comes into effect, you will no longer pay NGN50 on every PoS transactions you make. Except for amounts greater than NGN10,000.

You will only be charged NGN50 if the PoS payment is more than NGN10,000.

The new finance law will increase the threshold from NGN1000 to NGN10,000.

Banks will request TIN number before individuals could open a bank account

Currently, except when opening a corporate or current account, you are not required to provide a tax identification number (TIN) to open a Nigerian bank account. With the new law in place, all that will change.

Banks will now require individuals to provide their tax identification number before they can open an account.

Also, individuals with bank accounts will be expected to update their bank details with a TIN number. What this means is that you may be restricted from using your bank account until you have provided your TIN.

Here’s a detailed step by step guide to get your TIN

Impact on Employees and consultants

For employees whose employers remit PAYE, you’re most likely to have a form of TIN which we believe in the meantime, will suffice. So, you may not need to get a new tax identification number.

Also, if you’re a government consultant or have done business with organizations where Withholding Tax (WHT) is deducted, then you will have certainly obtained a TIN.

Businesses with less than NGN25 million annual turnover are exempted from VAT registration

Remember we mentioned the FG is planning to jack VAT from 5% to 7.5%? Well, the new tax law, tries to protect small and medium-sized businesses with an annual turnover of less than NGN25 million.

Businesses that fall into this category are not required by law to register for VAT collection. So, in a way, even though the government will increase the percentage of VAT taxable – it will be restricted to fewer organizations.

More ‘goods & services’ are exempted from VAT

In what many see as a move to reduce the tax burden on taxpayers, the new tax bill will remove several basic and essential goods and services from the VAT bracket.

For instance, all medical and pharmaceutical products, educational materials, medical services, baby products and basic food items are currently not VATable.

Once the new bill comes into effect, additional items such as locally produced sanitary products and tuition for nursery, primary and secondary education will be included in the non-VATable category.

Tax bonus for early tax return filing

To incentivize tax compliance, the new law will reward medium to large companies who file their taxes 90 days before the due date.

Medium-size companies can expect to save 2% of the total amount they are obligated to pay while large corporations can get up to 1% tax bonus for early filing.

According to a tax expert, Emeka Onwuka, Partner and Head of Family Wealth at Andersen Tax LP the incentive might not be enough to encourage businesses to file their tax return early, as he believed these companies can get better returns by investing, even if they invested in low-risk securities.

No company income tax for small businesses

In a bid to protect small businesses and to stimulate economic activities, small businesses with less than NGN25 million in annual turnover will be exempted from company income tax.

While medium-sized businesses with more than NGN25 million and less than NGN100 million in annual turnover will be required to pay only 20% as CIT.

Large corporations with more than NGN100 million annual turnover will pay 30% in company income tax.

What next?

Now that you know about the most significant impending tax changes that would affect your business from January 2020, you can now confidently examine and create processes that would help you comply with the new tax regime.

To learn more about the new tax legislation. Here.