Don’t let PayPal spoil your plans. See 14 other ways Nigerian freelancers can get paid by foreign clients.

Nigerians can only make payments with their PayPal accounts.

As a result, getting paid by foreign clients as a freelancer in Nigeria can be challenging. However, there are several channels you can leverage to safely and conveniently receive foreign payments in Nigeria.

And that’s what this post is all about.

Recommended For You: Learn everything you need to know about applying for the Tony Elumelu Entrepreneurship Programme, writing a stand out proposal, and winning the $5,000 grant. We even included a TEEP application checklist to help you stay on track. Start Your Journey Now

Here, we’ll explore 14 ways to receive money from foreign clients in Nigeria. For each channel, you’ll also see the ease of use, how customers rate it on Trustpilot, and the fees associated with using the channel.

So, let’s begin.

Table of Contents

Key Takeaways (Editor’s Picks)

- Grey.co is perfect if you wish to receive funds in different currencies in one place.

- Payoneer can provide you with a free USD physical debit card.

- Use Wire Transfer if you wish to move a large amount of funds into your bank account.

- Send online invoices and get paid in foreign currency with Invoice.ng.

- Get rewards for every online money transfer with Skrill.

- Protect yourself against fraudulent clients with escrow services.

- Leverage Upwork Direct Contract to get paid from non-Upwork clients.

- Create payment links with Flutterwave to get paid by foreign clients.

- Facilitate bulk international money transfers with Wise.

- Receive untraceable funds from foreign clients with cryptocurrency.

- Get paid to shop online with gift cards.

- Zinlin is your best option to receive funds from Latin America.

- Use Verifone, formerly 2Checkout to receive payment if you run eCommerce stores.

- Use WorldRemit to receive foreign payments directly into your bank account.

Recommended posts

- Top 15 (+15) Tools for Freelancers for Freelance Writers (Paid & Free)

- How Freelancers Can Retain their Clients: Advanced Customer Retention Guide

- 10 Ways Nigerian Freelancers Can Get Clients

1. Grey.co

Ease of Use: 4.5/5

Customer Rating: 4.2 out of 5 on Trustpilot (290 reviews)

Fees: EUR and GBP virtual accounts charge 1% for receiving payments.

Grey.co is one of the most popular platforms for receiving payments outside Nigeria. It helps users to receive, send, exchange, and manage multiple currencies in one place. You can also open US, UK, and EU bank accounts in a few minutes to access global payments wherever you want to.

The platform aims to provide inclusive global banking to users.

A customer said that Grey made it easy to move money into Nigeria at a time when it was virtually impossible to do so. He also claimed that they have excellent customer service and are always on top of their games,

Top Grey.co features for receiving international payments

- Supports foreign bank accounts.

- Allows currency conversions at competitive exchange rates.

- Offers virtual debit cards for local and international payments.

- Enables local and foreign money transfers.

- Supports mobile applications.

- Has built-in expense management features.

- Provides live chat support.

Why We Don’t Like It: The live chat support team is sometimes slow to respond, especially during holidays.

Verdict: We recommend Grey.co

How You Can Increase Your Earnings As a Freelancer In Nigeria

Learn 10 ways you increase your freelance earnings this year without going nuts. Our expert tips can help you build a financially rewarding freelancing career.

2. Payoneer

Ease of Use: 4.5/5

Customer Rating: 4.0 out of 5 on Trustpilot (52,210 reviews)

Withdrawal Fees: Up to 3% of transaction amount.

Payoneer empowers millions of businesses and individuals to make cross-border payments. The platform offers multi-currency accounts for those who need to make payments, get paid, and grow globally. It’s perfect for freelancers, businesses, and online marketplaces.

Over five million customers in more than 190 countries rely on this platform.

Daniel Lazarevski in the United States was impressed with the customer service. According to them, they responded to him promptly and resolved his issues within a few days.

Top Payoneer features for receiving international payments

- Allows users to request and receive payments from clients.

- Supports withdrawals from marketplaces like Fiverr, Upwork, and others.

- Lets users withdraw funds to their local accounts.

- Offers physical and virtual USD cards with free shipping to Nigeria.

- Lets users open bank accounts in America, Europe, and Asia.

Why We Don’t Like It: Nothing. However, some customers claimed that Payoneer’s account review process could take unnecessarily longer.

Verdict: We recommend this app.

3. Wire Transfer

Ease of Use: 5.0/5

Customer Rating: N/A

Pricing: Depends on the remitting (sender’s) bank.

A wire transfer is an electronic way to move money, usually through the SWIFT network or non-bank services like Western Union. It’s an effective way to send money between bank accounts in different countries. You only need to send your bank details, including the SWIFT code to use this channel.

Pros of receiving foreign payment through wire transfers:

- It’s safe, secure, and convenient.

- Payments through this channel don’t bounce due to insufficient funds.

- You can receive a large sum of money through this channel.

- SWIFT supports more than 11,000 banking institutions in over 200 countries.

Why We Don’t Like It: International wire transfers usually take up to three days.

Verdict: We recommend this channel.

4. Invoice.ng

Ease of Use: 5.0/5

Customer Rating: NA

Fees: 3.5% on all international payments

Invoice.ng is a Nigerian invoicing software that helps freelancers and businesses design professionally-looking invoices, receive payments, and manage their expenses. The solution promises instant bank settlement, allowing your bank account to get credited once the client’s payment is successful.

To use this solution, you’d need to create an account, connect your Nigerian bank account, and then create an invoice with the amount you wish to receive to get paid.

Top Invoice.ng features for receiving international payments

- Allows you to create beautiful invoices and send payment receipts.

- Accepts Mastercard, Visa, and Verve cards.

- Connects to all popular Nigerian bank accounts.

- Makes managing expenses a breeze.

- Provides comprehensive and intuitive financial reporting.

- Supports recurring invoice billing (you can schedule invoices weekly or monthly).

- Lets users send friendly payment reminders.

Why We Don’t Like It: Invoice.ng doesn’t offer live chat support.

Verdict: We haven’t used it to receive international payments and haven’t been able to find any customer reviews to gauge user experience. So, proceed with caution.

5. Skrill

Ease of Use: 4.0/5

Customer Rating: 3.6 out of 5 on Trustpilot (22,900 reviews)

Fees: Skrill does charge fees to receive money. However, fund withdrawals attract 1.99% to 3.50%, depending on the withdrawal method.

Skrill facilitates simple, safe, and fast online global payments.

It self-professes as an online wallet for money transfers and online payments. With this platform, you can receive money from clients in Nigeria, wherever they are. Skrill rewards you for nearly all transactions with points, which you can exchange for cash rewards, bonuses, and more.

Kelvin from Germany loves how intuitive and simple to use the app is. He also found the reward system impressive.

Top Skrill features for receiving international payments

- Offers mobile applications for quick and easy transactions.

- Supports international money transfers.

- Enables users to receive funds directly into their bank account and mobile or Skrill wallets.

- Allows you to buy, sell, or with cryptos.

- Supports online payments on hundreds of websites.

- Runs a loyalty programme that rewards you for every transaction.

Why We Don’t Like It: Responding to customer emails might run into days.

Verdict: We recommend Skrill.

6. Escrow Services

Ease of Use: 5.0/5

Customer Rating: NA

Pricing: Depends on the escrow service

Escrow services protect financial transactions between sellers and buyers. They do this by temporarily holding a fund on behalf of the buyer until the seller fulfills the contractual agreements. You can use this service to receive payments in Nigeria from your foreign clients.

The good thing with this channel is that it can eliminate the enforcement and KYC risks that are often involved with cross-border payments.

Top escrow services for receiving international payments

Why We Don’t Like It: Escrows extend the time it takes to get paid.

Verdict: We recommend using escrow services to receive foreign payments.

7. Upwork Direct Contract

Ease of Use: 4.5/5

Customer Rating: NA

Fees: Upwork takes 3.4% per contract

Upwork Direct Contract is another option to manage your contracts and receive payments from foreign clients as a freelancer. It’s perfect if you’re on Upwork but your client isn’t.

Upwork keeps the money in escrow. You only get paid when you request payment after completing the project and the client approves it. The fund goes directly into your Upwork balance and you can withdraw into your local bank account using any of Upwork’s withdrawal methods.

Top Upwork Direct Contract features for receiving international payments

- Allows freelancers to work with non-Upwork clients.

- Provides free dispute resolutions.

- Supports credit cards, PayPal, and U.S ACH bank transfers.

- Credits freelancers as soon as the work is done.

- Supports both hourly and fixed-price contracts.

Why We Don’t Like It: You can’t share the contract URL with clients. Only Upwork can email them the link.

Verdict: We recommend this solution if you have an Upwork account and your client doesn’t.

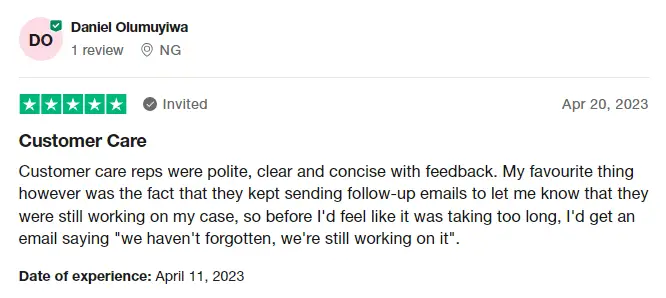

8. Flutterwave

Ease of Use:

Customer Rating: 2.4 out of 5 on Trustpilot (499 reviews)

Fees: Accepts 3.8% per international transaction.

Flutterwave aims to unlock boundless payment opportunities for enterprises, small businesses, individuals, and emerging markets. It lets you send money, process global payments, and launch financial products. It also lets you create a free eCommerce website and start selling online.

Over three million customers use Flutterwave, including top brands like MTN, Piggyvest, Chipper, and Microsoft.

A happy customer said that the customer care reps were polite, clear, and concise with feedback. What impressed him the most was that they kept sending follow-up emails while still on his case to let him know that he wasn’t forgotten.

Top Flutterwave features for receiving international payments

- Allows you to swap Naira for Dollars, Euros, and Pounds.

- Supports cross-border transfers in more than 30 currencies.

- Lets users receive online payments around the world.

- Enables users to receive one-off or recurring payments with payment links.

- Allows users to create and send invoices to get paid from anywhere.

- Supports over 15 payment options, including USSD, bank transfers, and debit and credit cards.

Why We Don’t Like It: More than half of reviewers rated it one-star on Trustpilot.

Verdict: Please proceed with caution.

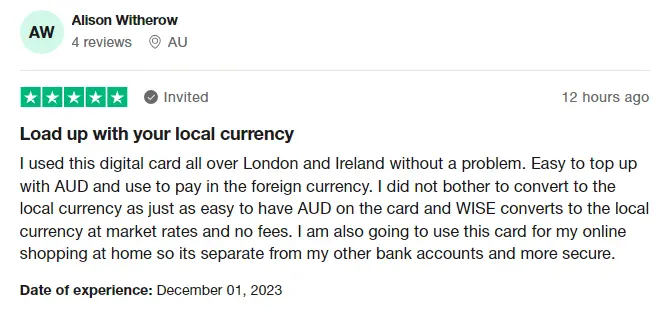

9. Wise

Ease of Use: 4.5/5

Customer Rating: 4.2 out of 5 on Trustpilot (201,129 reviews)

Receiving Fees: Free for non-wire payments and $4.14 per US wire payment.

Formerly Transferwise, this payment solution promises to help you save up to 5X when you send money worldwide. The dream is to help people live and work anywhere seamlessly, moving money across borders instantly, transparently, conveniently, and—eventually—for free.

Wise works in over 70 countries, including Nigeria, Australia, Canada, Ghana, the United Kingdom, and the U.S. Over 16 million customers use the platform.

Alison Witherson from Australia uses Wise virtual cards throughout London and Ireland without issues. She says it’s more convenient to top up with AUD and use it for online payment in foreign currency without needing to convert to the local currency first as Wise does it automatically at no fees.

Top Wise features for receiving international payments

- Allows users to send and receive international payments in over 40 currencies.

- Offers advanced security features.

- Provides both virtual and debit cards for international payments.

- Features an intuitive free invoice generator.

- Supports mass payment, up to 1,000 payouts in a go.

- Allows automated payment with the API feature.

Why We Don’t Like It: We couldn’t find live chat support for Wise.

Verdict: We recommend this international payment gateway.

10. Cryptocurrency

Ease of Use: 4.0/5

Customer Rating: NA

Pricing: Depends on the wallet

Cryptocurrency offers another cheaper and more seamless way to receive money in the country. It’s a digital currency secured by cryptocurrency that facilitates trustless transactions, meaning the participants don’t need to know or trust each other or a third party for the system to work.

Cryptocurrencies run on decentralised networks that allow them to exist outside the control and regulations of the government or central authority. You can use this channel to receive funds if you don’t want anybody looking over your shoulders or scrutinising you.

How to receive foreign payments with cryptocurrency

- Pick your preferred cryptocurrency wallet, like Atomic, Trust Wallet, or Binance.

- Sign up to create a USDT wallet. It’s a stable coin.

- Share your wallet address with your client.

- Swap to fiat like Naira, USD, or Euro

- Withdraw into your local bank account.

Why We Don’t Like It: Cryptocurrencies have high price volatility.

Verdict: Use only wallets that let you swap your crypto to fiat.

11. Gift Cards

Ease of Use: 5.0/5

Customer Rating: NA

Pricing: Differs, depending on the vendor and gift card type.

Gift cards are a great way to receive money outside Nigeria if you’re short of options.

These are temporary debit cards that are pre-loaded with cash to enable recipients to shop in specific retail stores. You can’t withdraw these funds, but some exchangers are willing to buy them. So, you can request your foreign clients to pay you by sending a gift card.

Popular Gift Cards in Nigeria

- Amazon gift

- iTunes

- Google Play

- Sephora

- AMEX

- eBay

- Nordstrom

- Steam’

- Vanilla

Why We Don’t Like It: Exchangers often buy gift cards below the real dollar value.

Verdict: We don’t recommend gift cards for receiving overseas payments unless you have a reliable exchanger.

12. Zinli

Ease of Use: 4.5/5

Customer Rating: 4.5 out of 5 on Trustpilot (295 reviews)

Sending & Receiving Fees: Free

Zinli is available in Nigeria. As a borderless international payment solution, users can send and receive from any country. This Latin American fintech aims to provide a dollar wallet to anyone who needs it. You only need to download the app and sign up with a government-issued ID to use the service.

A satisfied customer in Venezuela, Jefferson Sulbaran believes that Zinli is one of the best things that happened to him. The platform helps him safeguard the value of his money.

Top Zinli features for receiving international payments

- Supports physical and virtual dollar debit cards.

- Has mobile applications.

- Allows users to send and receive dollars.

Why We Don’t Like It: The default language is Spanish.

Verdict: Zinli is ideal for receiving payments from Latin America.

13. Verifone (Formerly 2Checkout)

Ease of Use: 4.0/5

Customer Rating: 2.6 out of 5 on Trustpilot (2,244 reviews)

Fees: Between 3.5% + $0.35 and 6% + 0.60 per successful sale depending on the plan.

2Checkout is an all-in-one payment gateway designed for digital goods and online retail businesses. It helps merchants maximise revenue and makes global online sales easier. The platform has over 20,000 customers and can support users in over 200 countries.

Stephano Polacchini says his experience with 2Checkout has been outstanding. According to him, the team is top-notch, always responsive, and helpful. Stephano noted that the company is up to date with the latest technology and trends, which has helped his business benefit from “cutting-edge features.”

Top 2Checkout features for receiving international payments

- Facilitates digital commerce and seamless global payments.

- Supports subscription billings.

- Integrates with over 120 shopping carts, including Ecwid, Magento, Shopify, and WooCommerce.

- Manages VAT and tax compliances.

- Supports B2B commerce.

- Provides insights reports and analytics.

- Supports up to 45 payment methods and 100 billing currencies.

Why We Don’t Like It: Users can’t make international money transfers with 2Checkout.

Verdict: Perfect if you sell products online, run a subscription-based business, or both.

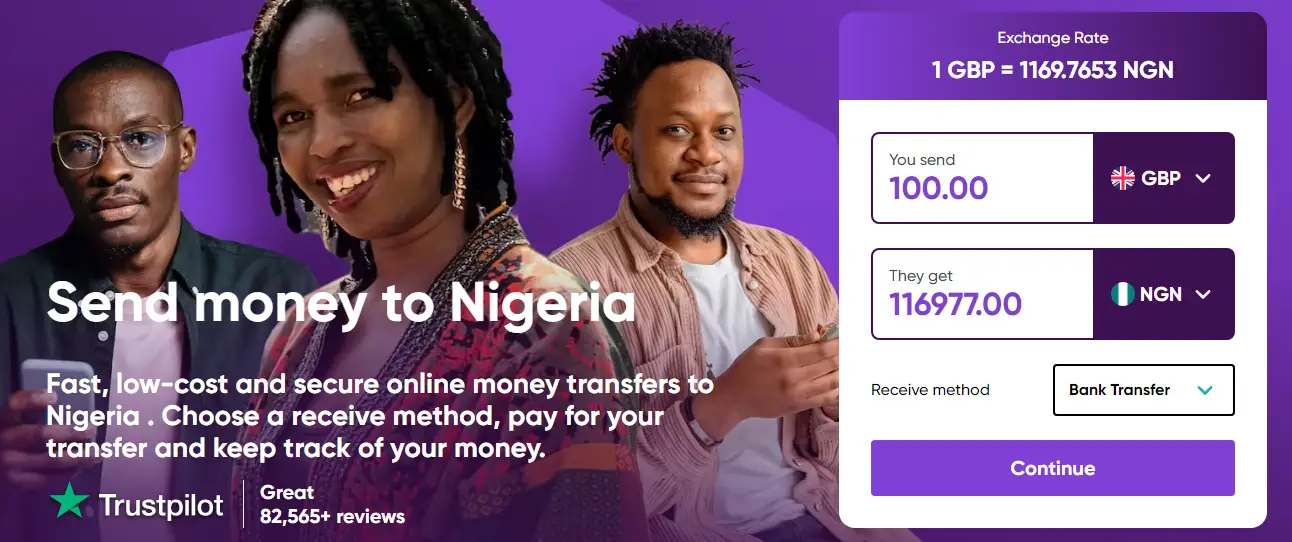

14. WorldRemit

Ease of Use: 5.0/5

Customer Rating: 4.0 out of 5 on Trustpilot (85,227 reviews)

Fees: Varies. Use the fee calculator.

WorldRemit now offers money transfers in Naira and dollars. It allows users to conveniently make safe and quick payments into any bank account in Nigeria. You can receive money through this channel even if you don’t have a WorldRemit account so far your client has an account.

However, we recommend signing up for an account to receive funds directly into your WorldRemit balance and then transfer the money to your Nigerian bank account.

Over five million customers use this service to transfer money worldwide.

A happy customer in the United Kingdom says that transferring with WorldRemit is easy and quick. He recommends the service.

Top WorldRemit features for receiving international payments

- Allows users to send money directly to a bank account.

- Supports airtime top-up.

- Comes with mobile applications.

- Offers cash pick-up.

- Supports mobile money payments.

- Receivers don’t need a WorldRemit account to get paid.

- Provides 24/7 phone call support.

Why We Don’t Like It: WorldRemit doesn’t offer live chat support.

Verdict: We recommend this service. The company says they’re 41% cheaper than sending money via most banks and their exchange rates are great too.

FAQs

How can I receive foreign payments in Nigeria?

There are several ways you can receive foreign payments in Nigeria.

The best option is to use online money transfer services and digital wallets like Grey.co, WorldRemit, Skrill, and Wise. You can also use online invoicing software that accepts international payments like Flutterwave and Invoice.ng.

Other options include using escrow services and accepting gifts and cryptocurrencies.

Is Zinli available in Nigeria?

Yes, Zinli is available in Nigeria. You can use it to receive online payments from any country. It’s a safe, quick, and convenient online solution for cross-border payments.

Any restrictions on the amount of foreign payments one can receive in Nigeria?

I don’t think that there are current government regulations that restrict the amount of foreign payments you can receive in Nigeria. However, some foreign payment channels might limit the amount you can receive. So, it’s important to verify with them before picking a channel.

How long does it take to receive foreign payments in Nigeria?

This depends on the payment method chosen, the banking institutions involved, and any potential delays due to regulatory processes. However, most online international payment channels are relatively fast.

Can I use online payment platforms to receive foreign payments in Nigeria?

Yes, you can. Online payment platforms like Skrill, Payoneer, Wise, Zinli, and others can help.

Now, What Payment Method Is Right for You?

Choosing the right payment method for your freelancing business is a big decision. As we’ve explored various options throughout this blog, it’s evident that each method comes with its pros and cons.

When deciding on the most suitable payment channel to use, consider factors such as the nature of your transactions, the level of security required, the convenience offered, and any associated fees.

Whether you opt for traditional methods like wire transfers or innovative online platforms like e-wallets, gift cards, escrow services, or cryptocurrency, the most important thing is to pick the method that best suits your needs and preferences.