Looking for ways to fund your small business in Nigeria? This blog post offers a comprehensive guide on how to get business grants in Nigeria. Learn the steps you need to take, the resources available to you, and the tips to increase your chances of success.

So you want to start a business in Nigeria? That’s a good decision.

With a population of over 200 million people, Nigeria has a large market of potential customers.

But there’s a problem you should know about. 80% of SMEs in Nigeria close their doors within the first three years of operation.

Recommended For You: Learn everything you need to know about applying for the Tony Elumelu Entrepreneurship Programme, writing a stand out proposal, and winning the $5,000 grant. We even included a TEEP application checklist to help you stay on track. Start Your Journey Now

To get a clearer picture, that’s 4 out of every 5 businesses. Disheartening, that’s one way to describe it.

Most of these businesses shut down due to a lack of funds. But avoiding such is possible.

You can sail through the stubborn waves of cash shortage as an SME with helpful business grants. And there are many such grants available in Nigeria.

In this post, you’ll learn how to get business grants in Nigeria to fund and grow your SME.

Let’s look at the benefits first.

Table of Contents

Need a Business Grant? Find the best business grants in Nigeria. Join hundreds of successful entrepreneurs using our grant application resource to secure their dream funding. Download the resource.

Top 20+ Business Grants to Fund your Business in Nigeria

Now, you don’t have to worry about funding anymore. Use this list of available business grants in Nigeria to expand your business.

We’ve rounded up 24 funding options for entrepreneurs. From Federal government agricultural grants, privately-funded grants for small businesses, and international entrepreneur grants.

No matter your industry, there’s a funding option for your business. All you have to do is pick one, make sure you meet the criteria, apply, and hopefully get the funding to start/expand your business.

How to use this list

To make wading through the list easier, we’ve grouped them into categories. Use the table of content to go to the section of the article that interests you.

For each grant, we explained what it is. How much you can potentially win. Then list out the criteria to become eligible. Finally, we shared how you can apply.

Need a Business Grant? Find the best business grants in Nigeria. Join hundreds of successful entrepreneurs using our grant application resource to secure their dream funding. Download the resource.

So, if you are ready, here are the top available grants in Nigeria to kickstart your dream business.

1. Tony Elumelu Foundation Entrepreneurship Programme

Launched in 2015 by Billionaire Entrepreneur and CEO Heirs Holdings, Tony Elumelu, the grant is a 10-year $100 million US dollar commitment towards empowering African entrepreneurs.

Since its launch, the foundation has disbursed $25 million worth of grants to 7520 entrepreneurs from Africa, making it the largest philanthropic institution on the continent.

Once you’re accepted as a TEF entrepreneur you can take advantage of the premium network of mentors, resources, and support you need to take your business from an idea to reality, to scale up and grow quickly.

So, it’s not just winning the grant; you also get invaluable professionals and experts you can turn to for help when needed.

Prize Money

Non-refundable seed funding of $5000

Eligibility

- You must have the legal rights to work in the African country you’re applying from.

- The Business must reside in Africa, and you must be a legal resident of any of the 54 African countries.

- Your business must be in an early stage of 0 – 3 years or a business idea.

- Your business idea must be for profit, focused on one business line, and be the original work of those applying.

- You must create an account on tefconnect, and complete an online entry form to apply for the program.

How to apply:

Visit tefconnect, the largest platform for African entrepreneurs. Complete the form and submit your application.

Recommended Posts:

- Tony Elumelu Entrepreneurship Programme: Everything You Need to Know

- How to Apply for Tony Elumelu Entrepreneurship Programme

- How to Write a Winning Tony Elumelu Entrepreneurship Program Proposal

A Nigerian Entrepreneur? See How to Write Business Grant Proposal

Here are step-by-step guide to write a winning business grant proposal in Nigeria. Use the tips here to win your dream grants.

2. Africa’s Young Entrepreneur Empowerment Nigeria (AYEEN)

One of the foremost entrepreneurial empowerment and funding platforms launched to mentor, guide, and provide funding for smart business ideas in Nigeria.

The AYEEN program annually attracts over 25,000 applications from young Nigerian entrepreneurs across 36 states.

However, its unique model means you can get funding for your business idea or be accepted into the mentorship program where you network, learn, and master key business skills essential to starting, running, and expanding your business.

Prize Money

Varying amounts of funding as deemed fit by the panelists. It can range from a couple of hundred thousand nairas to tens of millions.

Eligibility

- Must be running a business or has a viable business idea

- Open to all Nigerian entrepreneurs aged 18 and above.

- Must reside in Nigeria

How to apply

- Visit AYEEN website

- See the big bright button at the top right-hand side with “AYEEN 2019 Register Now”

- Click on it.

- On the new page, complete the form.

- Submit.

3. GroFin Grants for Small and Medium Business

A private development finance institution focused on providing medium-term finance loans and business support for small and medium-sized businesses in the manufacturing, agribusiness, education, healthcare, and key service sectors (energy, water, sanitation)

Since its launch in 2004, GroFin has supported over 700 SMEs, sustaining 89 740 jobs, and is present in 14 countries in the sub-Saharan and MENA regions.

Prize Money

Up to $1.5 million US dollars. A minimum of $100k

Eligibility

- Your business must be in any of the following sectors: healthcare, manufacturing, agribusiness, education, or in these key service sectors – energy, water, waste, recycling, and sanitation.

- Your business must be in any country where their offices are located – Nigeria, Kenya, South Africa, Zambia, Ghana, Ivory Coast, Senegal, Uganda, Tanzania, Rwanda, Egypt, Iraq, Jordan, or Oman.

- You need a medium-term loan of 100k to 1.5M US dollars.

- Your business is making a social impact – creating jobs, benefiting the environment, and empowering women.

How to apply

To apply online, visit: Apply

You Might Also Like: The Top 15 Small Business Challenges and How to Navigate Them

4. Shell LiveWire Funding

Shell LiveWire is a youth social development enterprise program focused on encouraging, training, and providing funding for youths to start a business.

The program is open to youths aged 18-30 from the Niger Delta region of Nigeria who desires to own a business.

Since its launch on March 27, 2003, the initiative has trained 6580 youths while 3373 participants were awarded grants to launch a business.

Prize Money

Unspecified

Eligibility

- Must be aged 18-30

- Has a viable business idea

- Undergone and graduated from their intensive entrepreneurship course

- Must be from Niger Delta – Abia, Imo, Edo, Rivers, Bayelsa, Delta, and Akwa-Ibom.

How to apply

Announcements would be made in national newspapers when open. Or visit here from time to time.

5. IB Plc Hero’s Foundation KickStart Program

IB Plc Hero’s Foundation KickStart program is a social investment initiative of International Breweries focused on instilling and encouraging entrepreneurial youths to pursue their dreams of launching a business.

The program has a three-way approach to training and boosting youth business capacity. Mentoring and guidance to leverage the expertise of experienced professionals and provision of grants.

Prize Money

Unspecified

Eligibility

- You must be a youth aged 18 – 35 years old

- Must be a Nigerian residing in the following states: Abia, Enugu, Imo, Anambra, Ebonyi, Edo, Delta, Rivers, Bayelsa, and Benue.

How to apply

Visit: KickStart and download the PDF application form.

6. GEM Grant

GEM grant is a funding partnership between the Federal Ministry of Industry, Trade, and Investment and the World Bank, which focuses on supporting manufacturing, entertainment, information and technology, tourism and hospitality, and agro-allied businesses.

Prize money

Minimum of $50,000 – $250, 000

Eligibility

- The lead institution is an academic institution, research institution, industrial center, business membership organization, or non-governmental organization, in partnership with at least 3 of any of the following: a for-profit private sector company(s), partnership(s), or sole trader(s);

- The lead institution must be operating in Nigeria;

- The total GEM funding requested must be at least $50,000 and no more than $250,000;

- The lead institution and its partners must together provide matching cash or cash equivalent funds of at least 50 percent of the total project budget;

- GEM funding must be requested for utilization on eligible costs or activities

- The institution must satisfy the requirements on Environmental and Social Compliance

- Other eligibility criteria will be added depending on the call for proposals

- The GEM funding requested must be utilized within 15 months; and

- The proposed idea must result in increased sales for the business, increased value

- added per worker and creation of new jobs

How to apply

Currently not accepting applications. Check

Related Post: 6 Unknown Alternative Funding Options for Small Business

7. African Entrepreneurship Award

African Entrepreneurship Award is powered by BMCE bank of Africa with a focus on providing a platform for mentorship, a network of ready-to-investor Angel investors, and grants to smart business ideas.

You can send in your application for one of the two categories – Innovation & Sports Entrepreneurship and Sports.

Prize money

A cash prize of $ 1 million is to be shared among finalists.

Eligibility

- You must be a citizen of an African country and at least 18 years.

- Your business idea must apply to the African setting and include a technological component.

- Your business idea must be for a profit with a social impact.

How to apply

Currently not accepting applications yet.

8. Innovation Prize for Africa

Innovation Prize for Africa is a platform with a mission to galvanize the innovative spirit of the African people to proffer solutions to their everyday challenges.

The Award is aimed at encouraging innovation-driven solutions to the myriad of challenges in Africa by Africans.

So, give this prize a shot if you have an idea or solution that can solve Africa’s problems.

Prize money

First prize – $1000,000

Second prize – $25,000

Third prize – $25,000

Recognition prize – $5000

Eligibility

- You’re a citizen of one of Africa’s 54 countries.

- African diasporans are also eligible if they show they hold an African country’s passport.

- The innovation is fully developed and not just an idea.

- All mandatory fields are completed.

How to apply

9. African Women Development Fund

A pan-African female-only grant-making organization that strives to support women’s rights and women-led organizations on the continent.

The fund provides grants to organizations tackling the issues of body and health rights, women’s economic security and justice, leadership, participation, and peace.

Prize money

Unspecified. However, since inception, the fund has given out $41.8 million US dollars.

Eligibility

- Must be led by a woman and have the majority of its staff and board being women

- Must be duly registered in an African country

- Must have been in existence for at least 3 years

- Must have the needed organisational structures for effective implementation of the project

- Must have an appreciable financial management system to properly account for funds received

- Must be capable of reporting back on the outcomes of the project

- Must complete the necessary application forms

How to apply

Visit here and follow the application guideline.

10. Unilever Young Entrepreneurs Award

Are you a social impact entrepreneur tackling one of the planet’s sustainability challenges?

Do you need support and funding to scale? Unilever Young Entrepreneurs Award might be just the right opportunity you need to take your business to the next level.

The program seeks to recognize and support young innovators providing solutions to some of the world’s challenges. Since its inception, the initiative has reached over 3700 young entrepreneurs, with 37 winners receiving funding and support.

Prize money

Winner – 50,000 Euros

A residential Accelerator Programme run by the University of Cambridge Institute for Sustainability Leadership, followed by a year of mentoring support tailored to their needs.

Eligibility

We’re looking for initiatives relating to one or more of the three categories we’re focusing on:

- Improve people’s health and well-being

- Improve the health of the planet

- Contribute to a fairer and more socially inclusive world

Whether it’s with an initiative, product or service, if you’ve gone beyond the idea stage and started to make an impact, we want to hear from you.

- Anyone around the world, excluding Russians aged between 18 and 35.

How to apply

You’ll need to complete your profile and describe your project to submit your application.

11. African Women Innovation and Entrepreneurship (AWIE)

AWIE is the number one female entrepreneurship platform that promotes, supports, and provides grants to brave, innovative female entrepreneurs across the African continent. The program seeks to accelerate the growth of female-led organizations for inclusive African economic growth.

Every year the program recognises women in private and non-profit organizations doing exploits across industries for their economic contribution to African growth and social impact.

Prize money

Not specified.

Eligibility

- Nominations should only be made relating to achievements made by a female entrepreneur and national (or permanent resident) of an African country with a registered business and operation in one or more African countries.

- Nominees can be nominated or self-nominated.

- A woman entrepreneur can be nominated for more than one category, but different nomination forms must be completed.

- You may be asked to support or verify the evidence you supply as part of the nominations you make.

- Five nominees will be shortlisted for each category and invited to the AWIEF Awards ceremony in October of the same year.

How to apply

Nominate a female entrepreneur here

Related Post: 8 Common Small Business Funding Mistakes You Must Avoid

12. YouWIN Connect Nigeria

YouWin is an acronym for Youth Enterprise With Innovation In Nigeria and is one of the social reinvestment programs initiated by the government.

The Youth Enterprise With Innovation In Nigeria initiative is a Federal Ministry of Finance multimedia program established under the administration of former President Goodluck Jonathan.

The program aims to promote entrepreneurship, job creation, and wealth via enterprise education for young Nigerians and funding for business owners nationwide.

YouWIN Connect provides a forum for young entrepreneurs to connect with industry experts to nurture their ideas, enhance job creation, and ensure business growth.

Also, participants receive business grants for winning the YouWin organized competition.

What sets YouWin apart from other programs is that it focuses on aiding individuals ages 18 to 45 to develop business plans or expand existing businesses.

The application process involves filling out an application form which includes several sections such as personal and company information. The application will be carried out in two stages – the YouWIN team will return very quickly to the pre-selected candidates after stage one.

Prize Money

Eligibility

- Must be between ages 18 and 45

- Must be a Nigerian by birth

- Your business must be located in Nigeria

- Must have a solid business plan with the potential to create job opportunities for Nigerians.

How to Apply

- Visit: https://apply.youwin.org.ng/registerp.php

- Sign up and confirm your registration via email

- Sign in and complete registration by filling in the required information.

- Click submit.

Amount

Between one to ten million.

13. Youth Empowerment Nigeria (YEN)

As the name suggests, YEN is a youth-run initiative that helps Nigerian youths engage in productive activities.

Youth Empowerment Nigeria (YEN) is a non-profit organization established to empower youths in numerous areas of life, such as capacity building, skill acquisition, loans, entrepreneurship, and management skills.

The YEN initiative aims to tackle job scarcity, leadership, and social work issues, through skill acquisition, loans, and especially grant opportunities which you can benefit from for free.

If you fall within 16 and 21 and need more financial backing to kickstart your business, we recommend applying for YEN grants.

We’ll show you how.

Prize Money

Unspecified.

Eligibility

- Two recent passport photographs

- Photocopy of your national Identity card

- Photocopy of a utility bill

- You must submit a business proposal or summary to the YEN office or send it via email to smescheme@youthempowermentnigeria.

- Must be between ages 16 and 21

- Must be a Nigerian citizen

How to Apply

- Visit the YEN website or office near you

- Complete and submit your application form

- Once you qualify, you’ll receive information on your appointment date for your business proposal defense.

- If successful, you’ll receive grant funds within ten days after the appointment.

14. Africa’s Business Heroes Funds

Africa’s Business Heroes Funds is a philanthropic program by the Jack Ma Foundation that supports African entrepreneurs who positively impact their communities and beyond.

The program provides grant funding, training, mentoring, and networking opportunities to ten African entrepreneurs yearly who compete in a TV show and a pitch competition.

Africa’s Business Heroes Funds is open to entrepreneurs from all African countries, all sectors, and all ages who operate businesses formally registered and headquartered in an African country and that have a three-year track record.

The program aims to showcase and inspire a movement of African entrepreneurship and solve Africa’s most pressing problems.

How to Apply

- Fill out and submit the application form from the ABH website (you’ll be asked to provide personal and business information like your motivation to join the program)

- If your application meets the eligibility criteria, you will be invited to take an online business assessment test that evaluates your business skills and knowledge.

- After passing the business assessment test, you will be asked to submit a video pitch of your business. The video pitch should be 15 minutes at maximum and cover your business model, social impact, competitive advantage, and growth potential. The video pitch should be in English or French with English subtitles.

- Lastly comes the personal pitch. If selected as one of the top 50 applicants, you will be invited to pitch your business to a panel of judges. The judges will choose the top 10 finalists competing in the grand finale.

Eligibility

According to the Africa’s Business Heroes website, the eligibility criteria for the program are:

- You must be the founder or a co-founder of your business.

- Only Africans or direct descendants of an African citizen can apply

- You must have a registered company that primarily operates in an African country.

- Your business must have market traction and at least three years of revenue.

- Your business must be profit-based and have a social impact.

15. Women in Africa (WIA) JAMII Femmes Grant

The WIA54 program is a Women in Africa (WIA) initiative aims to support ten thousand African women entrepreneurs by 2030 through training, mentoring, communication, and access to finance.

The goal is to contribute to creating 100 thousand jobs and to generating ten billion dollars in revenue for the African economy by 2030.

Also, the WIA 54 program includes a pitch competition where participants can compete for funding and other resources to support their businesses and initiatives.

Eligibility

Business must be owned or operated by an African woman

How to Apply

Visit https://wia-initiative.com/fr/wia54-2/ and follow the instructions

Prize Money

Up to ten thousand dollars

16. Black Founders Fund Africa

The Black Founders Fund Africa is a Google for Startups initiative that provides African Black-founded startups with access to funding.

The fund aims to help Black founders in Africa overcome the challenges of accessing capital and networks and to support their growth and impact.

The fund provides up to 100 thousand dollars in equity-free cash, 200 thousand dollars in Google Cloud Credits, and access to the best of Google—people, products, and practices.

Black Founders Fund Africa is primarily for startups with self-identifying black leaders or companies directly supporting the Black community.

Prize Money

Up to 100 thousand dollars worth of capital

Eligibility

- A startup headquartered in Africa or has a legal presence on the continent

- Your startup must have a technology-based product or service in the early or growth phase

- Business must create jobs, has growth potential to raise more funding, and thereby make an impact

- The startup must directly support the Black community with at least one Black C-level founding member

- The startup must possess compatibility with Google products

How to Apply

Visit https://goo.gle/ApplyforBFFAfrica, for comprehensive information on the eligibility requirements and instructions on completing the application process.

17. UNICEF Innovation Fund

The UNICEF Innovation Fund is a financial vehicle that invests in early-stage, open-source, emerging technology solutions that have the potential to impact children and the world on a global scale.

The fund provides up to 100 thousand dollars in equity-free funding, product and technology assistance, business growth support, and access to a network of experts and partners.

The fund focuses on solutions clustered around 100 billion dollars in industries in frontier technology spaces, such as blockchain, drones, artificial intelligence, machine learning, data science, extended reality, etc.

Also, the fund aims to build successful digital solutions into global digital public goods, ensuring fair, equitable, and open access to these human development tools for human development.

The fund is part of the UNICEF Office of Innovation, which also runs the UNICEF Venture Fund that makes early-stage investments in technologies for children developed by UNICEF country offices or companies in UNICEF program countries.

Prize Money

Unspecified

How to Apply

To apply for the UNICEF Innovation Fund, you need to follow these steps:

- Submit an online application: You need to fill out an online application form on the fund website and provide information and supporting documents about your startup, your solution, your team, your market, your impact, and your funding needs.

- Wait for the selection process: If your application meets the eligibility criteria, you will be contacted by the fund team to conduct a due diligence process. This process will verify your information, financial statements, legal documents, and references.

The fund team will also assess your solution’s technical feasibility, scalability, sustainability, and potential impact. Finally, the fund team will select the most promising startups to receive funding and support from the fund.

Requirements

- Must be a registered private company

- Your business must be registered in a UNICEF program country

- Your business model must aim to provide a solution that will potentially impact the lives of the most vulnerable children positively

- Generating publicly exposed real-time data that is measurable

18. United States African Development Funds

USADF promotes economic development in Africa by supporting small and medium-sized enterprises (SMEs) that benefit low-income communities in sub-Saharan Africa.

The organization provides funding, technical assistance, and capacity-building support to local organizations to create jobs, improve incomes, increase food security, and enhance access to social services.

USADF collaborates closely with local partners and has a history of engaging with marginalized communities in hard-to-reach areas.

You can apply for a USADF grant if you meet the eligibility requirements.

Prize Money

Up to 250 thousand dollars

Eligibility

To apply for a USADF grant, you must be an African-owned and African-led enterprise that improves the lives and livelihoods of people in underserved communities in Africa.

How to Apply

To apply, visit the USADF website and complete the provided online registration form.

19. Africa Cocoa Fund to Support Cocoa Famers in West & Central Africa

The Africa Cocoa Fund (ACF) is an initiative of the Rainforest Alliance Organization to support cocoa farmers in West and Central Africa.

The fund is a 3-year program that aims to create measurable, long-lasting positive impact by building the capacity of certified cocoa farmers who most need assistance to implement sustainable agriculture.

Prize Money

$5 million total prize money, with $500,000 to be distributed among farmers in 2020. There will be additional calls for application in 2021 and 2022.

Eligibility

Eligible farmers fall into two categories:

- Category A – Primary focus

- Category B – Secondary focus

See the link below to learn more about each category.

How to Apply

Application is open till 2020 September, 30.

Fill out the Application Form to apply.

To ask questions, please contact: acf@ra.org

20. ESP Launches Zero-Interest Loan Program to Support African SMEs in a COVID-19 Economy

The African Resilience Initiative for Entrepreneurs (ARIE) is an interest-free loan program to help 300 entrepreneurs across 7 African countries.

The initiative was launched by Entrepreneurial Solutions Partners (ESP) in partnership with the U.S. African Development Foundation (USADF) and in collaboration with Ecobank.

ARIE aims to provide technical and financial assistance to entrepreneurs, with 70% of the beneficiaries awarded to female-owned businesses.

Prize Money

Beneficiaries can expect to receive technical support and networking opportunities and up to $150,000 per firm.

Eligibility

- Must be a firm registered in any of these 7 African countries: Nigeria, Ghana, Ivory Coast, Kenya, Rwanda, Senegal, and Uganda.

- The company must be in any of these sectors: Manufacturing, Agri-business, energy and renewables, and Essential services.

How to Apply

Application is open till the 25th of September, 2020

For more information, contact: arie@espartners.co

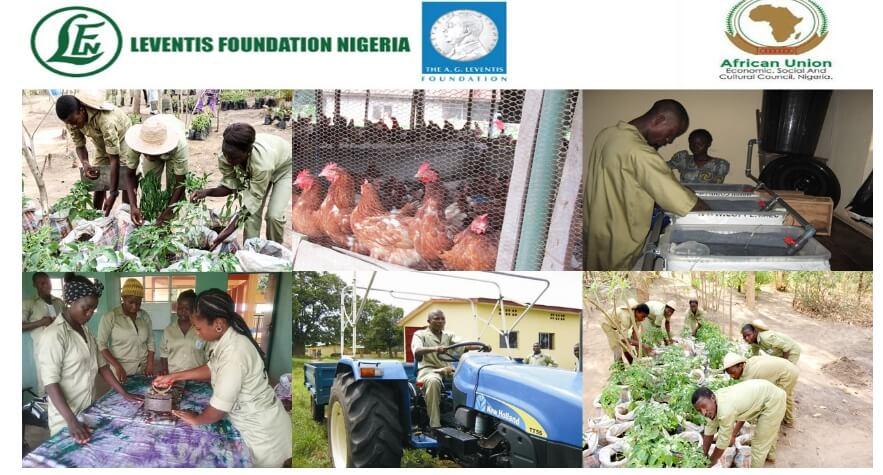

21. Agricultural Youth Summit Grant

Leventis Foundation Nigeria, in collaboration with African Union, Economic, Social and Cultural Council, Nigeria (AU-ECOSOCC, Nigeria), is awarding a grant to two youth-led agribusinesses as part of the 2020 Agricultural Youth Summit.

Prize money

NGN500,000.00

Eligibility

- Youth-led agribusiness

- Must be a Nigerian with a business located in the country.

- Follow Leventis Foundation on all social media platforms.

How to Apply

The application is closed. 5th August 2020

22. Nigeria Impact Startup Relief Facility nisif

Nigeria Impact Startup Relief Facility (NISRF) is an emergency fund launched by a consortium of funding partners to help existing post-MVP stage high-growth startups weather the impact of covid-19.

Prize Money

- $5000 – $20,000 equity-free grants.

- Beneficiaries gain access to high-powered business mentors

- Business continuity solutions.

Eligibility

- Must be operating in Nigeria

- Your startup should be tackling urgent social problems.

- Must be post-MVP, revenue-generating, and registered with CAC

- Have solid financial health pre-covid (USD 60K ARR – 12 months minimum).

- Have received seed funding in the past

- Your business should be scalable

- Must be in any of the following industries: Agriculture, Critical infrastructure, Financial services, Health care, education, and initiatives that target the informal sector.

How to Apply

23. Greenhouse Lab: The First Female-Focused Tech Accelerator in Nigeria

Greenhouse Lab is a GreenHouse Capital-backed 3-month accelerator focused on female-led tech startups solving some of Africa’s biggest problems.

Prize Money

- Access to a global network of investors, corporate partners, and mentorship

- Access to products and resources from GreenHouse Capital.

- Opportunity to work out of Vibranium Valley, Lagos.

- Receive up to $100,000 funding.

Eligibility

- Must be an early-stage startup with at least one female member on the founding member team.

- Must be solving a critical problem in Africa.

- Must be scalable

- Team must consist of at least two members, with one technical member

- Must have developed an MVP

How to Apply

24. Global Youth Empowerment Fund Grant

The Global Youth Empowerment Fund is an initiative of JCI, and the SDG Action Campaign focused on providing funding, training, and mentorship to youth-led projects and social enterprises.

The program aims to empower youths from around the globe who are impacting their communities by investing in grassroots community projects that advances the Global Goals for Sustainability.

Prize Money

Not available

Eligibility

- Youth-led projects advancing global goals for sustainability

- Focused on impacting communities and the grassroots.

How to Apply

Benefits of Business Grants in Nigeria

Business grants have several benefits, and they include:

- Access to quick money: Of course, business grants provide quick money to help scale your business. You can get huge amounts from grants, provided you have a dependable business idea.

- Access to future benefits: When you receive a grant and perform well with the funds, you become eligible for future grants. Think of it as getting a higher credit score by making good use of your finances.

- Flexible terms: Business grants differ from loans because you don’t have to repay. With this, you typically get longer deadlines and more suitable terms to present returns. In fact, some donors will let you set the deadline.

- Boosts credibility: A business grant can expand your customer base in Nigeria. For instance, you win a grant from the government or a top private company. It shows the government/company trusts your business. In turn, customers, too, will trust you.

Business grants have all the above benefits, but there are also some downsides. Notably, there’s serious competition – you’re not the only one in need of a grant, of course.

Also, it can be time-consuming. Time-consuming because you need to research and process paperwork to identify the right grant and present a worthwhile business proposal.

But there’s Good News.

You can use our resource at Smart Entrepreneur Blog to quickly find and easily win small business grants in Nigeria.

Recommended Post: [UPDATED] 22 Verified FG and International Grants For Small Businesses In Nigeria

Use this Online Resource to Win Business Grants In Nigeria

We aim to help small businesses grow and succeed. And our online small business grants resource is a testament to that.

The resource brings you the best business grants from all corners of Nigeria and beyond. These grants are from federal and state governments, private companies, and international organizations.

More than 380 SME owners in Nigeria are already using our resource. You should too.

Regardless of your industry and vertical, there is something for you. Also, grants to expand your business, launch a new product, or invest in new tech are available. Additionally, you will gain access to gender-specific grants specially designed for female-owned businesses.

Besides these, the resource includes tips to help you win applications.

Getting Small Business Grants In Nigeria

In five simple steps, you can use our online resource to get small business grants in Nigeria. Check them out below:

Download the resource

The first step is to download the resource. And for that, you’ll have to pay – guess the amount – just N1,999.

You’ll agree that it’s affordable, considering N1,999 is less than the price of a decent meal in Genesis Restaurant.

Making the payment is easy, and you can do so using your debit card, USSD, or bank transfer.

We use Paystack, which means you can pay with your VISA, MasterCard, Verve, or American Express card. Apple Pay is also an option.

Once payment is confirmed, you’ll be automatically redirected to a page where you can download the resource.

Pick your preferred funding option

After downloading the resource, next is to select a funding option.

As mentioned before, there are different grant funding options available. You may want a federal government grant, state government grant, local company grant, or international company grant. It’s up to you to decide.

Also, you can select grants specific to your industry.

Some top industries with available funding options include information technology, education, manufacturing, social entrepreneurship, and agriculture.

These are clearly laid out, so picking an ideal funding option will be seamless.

Check the eligibility criteria.

Different business grants have different eligibility criteria.

You must confirm you meet these criteria. Failure to meet the criteria automatically voids your application. We don’t want that to happen, so our resource includes all the eligibility information you should know.

Usually, the eligibility requirements center on your business proposal idea and size.

For example, if you identify as an SME, you must meet the size standards of SMEs in Nigeria.

For the business idea, it pays to have an innovative proposal. That way, you stand out from the competition. And your chances of winning the grant are higher.

Apply for grants

So you’ve found your preferred grant, and you meet the eligibility requirements. Now, you can proceed to apply for the grant.

Our resource includes tips for crafting a winning grant application. However, hiring a professional grant writing service is still a good idea.

These services have the experience and expertise to land your preferred business grant.

There are many such professional grants writing services in Nigeria. Pick one based on qualifications, history, and price. We can also connect you to one.

Once your grant application is ready, submit it following the instructions by the fund-providing body.

Scale your business funding

If your grant application is successful, you’ll receive the funds in the stipulated time. Then, you can start working towards growing your business.

Additionally, you explore other funding sources to inject more capital into your business and scale your funding. We recommend low-risk funding options like term loans, debt for equity financing, angel investors, and crowdfunding.

Related Post: 4 Super-Smart Instant Funding Options to Grow Your Business Fast

Why you should use this business grant resource

Using our online resource gives you an advantage in finding grants for your SME business. Here’s why you should use it:

- It saves your time: Traditionally, you’ll need to search the web — and even offline publications — searching for loan grants. Doing so will take a lot of time. With our resource, you get many grant funding options in a single location.

- It gives you limitless options: With our resource, there’s no limit on the grant options you can apply for. There are grants from the Nigerian federal and state governments. There are also grants from companies within and outside the country.

- It helps you select the best grant option: Not all grant funding options are favorable. Some may put your business in a bad light if you fail to make returns. That’s why our resource only curates the best grant options. Grant options with favorable eligibility requirements that any SME can cope with. You can choose grant options particular to your business industry.

Securing SME Grants In Nigeria: Now, What Next?

Getting business grants to fund your SME in Nigeria is easy with our online resource. And all of it is for an affordable N1,999 price.

However, the resource can only help you win grants. What you do with the funds — whether your business grows or not — is up to you.

Therefore, ensure you have a strategic business plan to put the funds to good use.

Recommended For You: Business Growth Strategies: Top 10 Ways to Grow Your Business this Year

Hand-Picked For You:

- FAQs: How to Start a Business In 2023

- FAQs: How to Grow Your Business In 2023

- FAQs: How to Fund Your Business In 2023

- Top Small Business Challenges and How to Navigate Them

- How to Rank On the Google First Page

- Backlink SEO Strategy: How to Build Quality External Links

- Small Business Leads Generation Strategies: How to Scale Your LeadsIn 2023

Nigerian Business Grants Frequently Asked Questions

Are business grants a good funding source?

Yes, business grants are a good funding source. This is because they are essentially free money — money that you don’t have to pay back.

But you must do something productive with the grants you receive. If not, grantors will see your business as wasteful. Thus, getting future funding will be difficult.

Does the CBN offer business grants in Nigeria?

The CBN offers many small and medium enterprises development funds and schemes. These schemes provide direct and indirect funding to businesses in Nigeria.

However, some of them are loans and require repayment. Also, note that most CBN grants are not periodical.

What is the best business grant for small businesses in Nigeria?

Some of the best business grants for small businesses in Nigeria include:

- Tony Elumelu Entrepreneurship Programme (TEEP)

- GroFin Fund

- AYEEN Financial Grants

- SMEDAN Grant For Entrepreneurs

We advise you to use our online resource to find the best business grant particular to your business type.

Are international business grants good for me?

International business grants are a good option for Nigerian businesses. Grants like those from the World Bank, GroFin, International Monetary Fund, and USADF are helpful.

However, international business grants usually have stricter eligibility criteria than their local counterparts. This is because they command more competition.

Grants or Loans? Which is best for me?

Grants are better than loans. The primary reason is that you don’t repay grants, but you repay loans.

Nevertheless, a loan can still be a good option if you can’t get a grant. Ensure you trust your business plan to generate income to repay the loan on time.

How much grant funding does SMEDAN provide?

The Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) gives grants up to 10 million Naira for Nigerian entrepreneurs through its annual National Business Plan Competition.

The competition selects the top 10-15 business plans to be awarded grants to help launch and grow their companies. The grant amounts can vary from 1 million to 10 million Naira based on each winning business proposal and its fund requirements.

In addition to grants, SMEDAN winners get business mentorship support, regulatory assistance, and entrepreneurship training. So the competition is about more than just funding, but also building capacity for new businesses.

What are the top grants for agriculture businesses in Nigeria?

If you’re planning to launch or expand an agriculture business in Nigeria, there are a few great grant options to explore, such as the Tony Elumelu Foundation grant.

It provides seed funding to African entrepreneurs in all industries including agriculture. Their non-refundable grant has helped kickstart thousands of new companies across the continent. Other foundations sometimes offer agriculture-specific funding as well, so keep an eye out for those.

How can I find grants specifically for women entrepreneurs?

Fortunately, there are a number of organizations that offer grants aimed at supporting women-owned and women-led businesses in Africa.

Two great examples are the African Women Development Fund and the African Entrepreneurship Award from BMCE Bank of Africa. Both offer funding opportunities specifically for female entrepreneurs on the continent.

What grants help companies in the manufacturing industry?

For Nigerian manufacturing companies and factories looking for funding, the GEM (Growth and Employment) grant program is an excellent option to look into.

It partners the Nigerian government with the World Bank to support domestic manufacturing. Any type of manufacturing, processing, or production business is eligible to apply for grant funding between $50,000 to $250,000 from GEM.

Do I need an existing business to qualify for grants?

This depends on the specific grant. Some funding opportunities like SMEDAN do require that your business is legally registered and has been operational for a minimum period, usually at least 1-3 years.