Companies currently grapple with the rising costs of gas, labor, and supply. Understanding inflation and how it affects your small business is the first step to mitigating its impact.

We’ve all heard about rising inflation. An economic phenomenon that describes the rising price of goods and services.

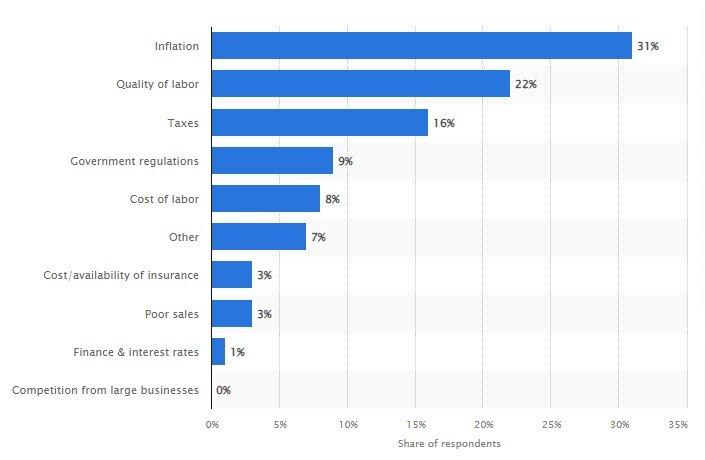

While most of the discussions are centered on the effect of inflation on consumers – the reality is that small businesses also struggle with this economic trend so much so that most business owners in the U.S. ranked rising prices top of the list of the single most important problem they face.

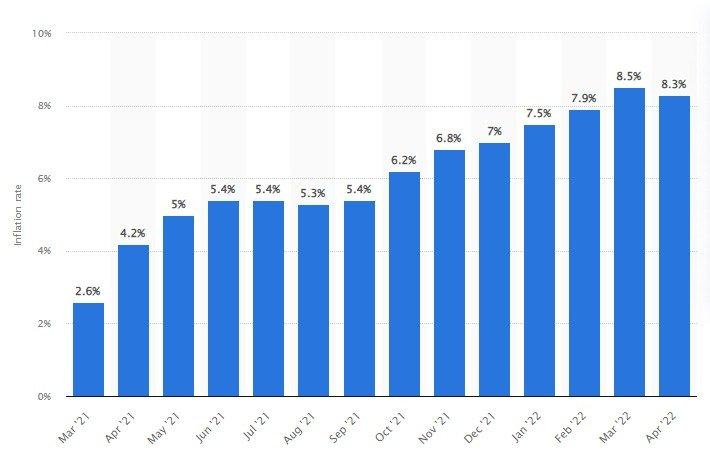

A Quick Look At US Inflation Rates Over The Years…

Since April 2011, the annual inflation rate in the United States has jumped from 3.2% to 4.7%.

Want to Grow Your Real Estate Business? Download the Complete Grant & Funding eBook for instant access to grants, guides, and more. 80+ Grant and Scholarship Opportunities (FG, State-by-State, General & Underrepresented Groups Scholarships, Plus Grant Writing Checklist). 900+ Copies Sold Already. Get Your Copy Now

Meaning nearly 2% of the dollar’s purchasing power has eroded over a ten-year period. Sadly, experts forecast that this trend is expected to continue in the near term.

On a longer time scale, the inflation rate is manageable and doesn’t get the bells ringing. However, when viewed on a short time horizon, like the YoY inflation rate, it becomes an entirely different keg of fish.

For instance, in March 2021 the inflation rate in the U.S was 2.6%, fast forward to April 2022 and inflation was 8.3% – a 69% jump.

Though, authorities say this is transitionary and that there’s nothing to worry about many small businesses are feeling the bite.

But, What Exactly Does Inflation Mean?

Inflation simply means the rate of increase in prices over a given period of time.

It measures how much more expensive goods and services have become, usually measured in a twelve months interval. (IMF)

Investopedia defined it as:

The decline of purchasing power of a given currency over time.

When you can no longer get a product or service you usually buy with a certain amount of money – we say the dollar has lost its purchasing power, and that’s inflation.

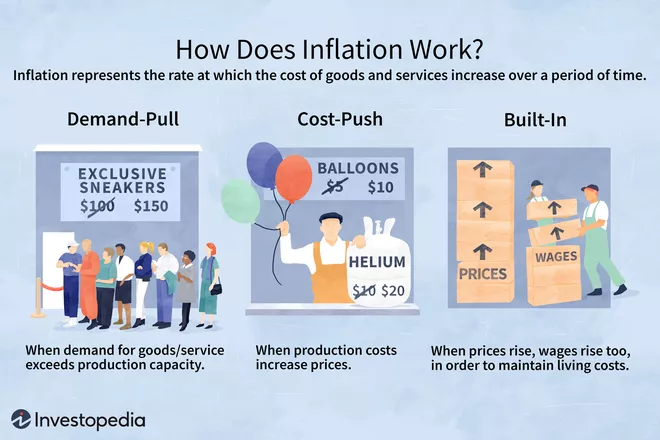

This graphic from Investopedia aptly described what happens in an inflationary economy

What Causes Inflation?

Inflation is directly tied to a country’s monetary policy. An increase in the supply of money without a corresponding product or service to match can have an inflationary effect.

In other words, more money in circulation leads to inflation.

However, this often plays out in various ways in the economy, leading to the different types of inflation.

Types of Inflation

Demand-Pull Inflation

Demand-pull inflation occurs when too much money is chasing a few goods or services.

Think of it like this – an increase in demand causes prices to rise since there’s a supply of more people ready to buy than the available products.

Interestingly, a major trigger for this type of inflation is often the government’s economic policies aimed at stimulating the economy.

Take for example, during the Covid lockdown, the Biden administration pushed trillions of dollars into the economy without a corresponding economic output.

And this is probably, a major driver for the recent jump in inflation rates.

Cost-Pull Inflation

This type of inflation occurs when the cost of production rises, causing manufacturers and companies to pass the additional cost to the final consumer.

The rise in production costs could be due to natural disasters that disrupt the supply chain or rising costs of raw materials, which reduce overall supply.

Speculatory (built-in) Inflation:

When firms expect prices to continue to rise at the same rate, they tend to negotiate contracts based on these rates to offset any value loss due to inflation.

On the other hand, employees will also demand wage increases in anticipation of rising in the cost of living so they can maintain their standard of living.

And as Investopedia explained:

The increased wages result in a higher cost of goods and services, and this wage-price spiral continues as one factor induces the other and vice-versa.

Is Inflation Good For Small Businesses?

The answer is – it depends.

You see, while most business owners have had to contend with rising costs of labor, transportation, and inventory (which can be seen as being bad for business), some businesses benefit from these rising prices.

On the downside, an inflationary economy drives up labor costs, as employees demand wage increases to compensate for rising prices.

However, employers can offset these increased overhead costs by raising the prices of their goods or services without losing customers, since almost everyone in the economy is also reviewing prices upwards too.

For companies that need raw materials for production, inflation could mean paying more to purchase the same quantity of inputs.

On the other hand, it also means that those that have well-stocked inventory could be sitting on materials that are significantly worth more than what was initially paid for them.

So you see, for every downside of inflation, one can point to those benefitting from the economic trend.

How To Hedge Against Inflation (Protect Your Business Against Rising Prices)

Inflation is an inevitable part of the economy. It is a necessary tool for incentivizing production.

A slight increase in prices here and there is good for the economy.

You see, when people know that prices will rise, they’ll be keener to produce in order to take advantage of the price action.

However, inflation can become counter-productive, when the rising prices get out of hand.

In this section, our focus is to share some of the proven strategies you can implement to protect your business from rising prices.

In other words, we want to help you hedge against inflation.

The key, from our research and experience to weathering inflation and coming out stronger is to have robust cash flow management.

This implies, reducing costs as much as you can and figuring out new revenue sources.

The key to beating inflation as a small business is to ensure a robust cash flow to cushion the effects of rising costs.

Cutting Costs Where Possible

The first place you can look for opportunities to reduce costs is in your processes.

Focus on identifying inefficiencies in your process and streamline or automate the tasks that can be automated to improve efficiency.

Improved efficiency means you have more time to focus on other aspects of the business, which in turn, leads to increased productivity.

You can also renegotiate existing contracts with your suppliers (where possible) to reflect the evolving business scape and get more favorable terms.

Also, finding new suppliers who can supply the same products but at lower rates is another cost reduction option you can explore.

Raise Prices To Keep Up With The Rising Costs of Goods And Services

This is a catch-22 situation. When you raise prices, you risk losing customers. However, if you do nothing, you risk being run out of business because of rising costs.

So, how do you raise prices without annoying your customers?

First, you have to be transparent with your customers. Explain to them the situation you’re in and the risks if you don’t raise your prices soon.

Most people won’t mind a reasonable price increase, especially since it’s an economy-wide issue.

You can also increase prices gradually instead of doing so in one fall swoop. This way, your customers can get accustomed to the new prices without feeling the pinch.

Diversify Your Products And Service

Take stock of your offerings and see if there’re opportunities to offer more (related) products or services to your customers.

For example, if you carry only one product, you may want to expand your catalog to include other related services or products that can go with the existing line.

Offer more premium packages if you haven’t done so already or bundle several services into a single offer with a higher price tag.

Remember, the aim is to offer more products or services that can help minimize the effect of inflation as well as protect your bottom line.

So What’s Next?

The fed’s just announced an 8.6% inflation for May 2022, a record hike in prices since 1981.

And as it appears, things are not slowing down anytime soon.

So, as a business owner, you’ll have to keep a handle on your business’s financial health.

Hopefully, the tips shared in this post will guide you as you navigate these trying times.

We’d like to hear about how inflation has impacted your business and how you’ve been coping.

You May Also Like:

How Successful Entrepreneurs Manage Change

4 Super-Smart Funding Options To Grow Your Small Business

Budgeting For Small Businesses