Here are 7 proven tips to sell insurance virtually during the pandemic. In this guest post, David Duford shares 7 insightful tips to help anyone crush their insurance sales call.

Would you like to sell insurance despite the current coronavirus pandemic?

Perhaps, you’re concerned about face-to-face appointments and wondering whether selling virtually (over the phone) is a viable business model. If that’s the case, you’ve found the right article!

Today, I’ll explain how to sell insurance virtually! Let’s get started.

Want to Grow Your Real Estate Business? Download the Complete Grant & Funding eBook for instant access to grants, guides, and more. 80+ Grant and Scholarship Opportunities (FG, State-by-State, General & Underrepresented Groups Scholarships, Plus Grant Writing Checklist). 900+ Copies Sold Already. Get Your Copy Now

7 Practical Tips on how to Sell Insurance Virtually During The Pandemic

Tip #1 – Remember, Sales Is Sales

Many of my readers today likely come from a face-to-face sales environment. As such, you’re probably thinking that doing business over the phone is vastly different than in person.

But to be honest, it’s not. In my experience, I’ve found there to be more similarities between the two techniques than differences.

So, here’s my first piece of advice: don’t freak out!

You don’t have to switch up your entire sales process just because you’re now selling insurance over the phone.

Just like face-to-face sales, you still need to build rapport, establish trust, pre-qualify your client, build value, and ask for the sale.

The biggest hurdle regarding virtual sales is the trust element. Some agents rely on Zoom to overcome this. However, trust can be built over the phone exclusively – as proven by agents at my agency.

Then, how do you establish trust virtually?

The key is to focus on rapport-building and pre-qualifying more heavily than you would in person. Over the phone, your clients can’t see you. So, you have to work harder to get them to trust your expertise and experience.

Tip #2 – “Use” the Pandemic

The great thing about virtual sales right now is that we have the perfect reason to conduct sales over the phone.

It used to be a challenge to get clients on board with the virtual process. But, the pandemic makes doing business over the phone more excusable than ever.

Emphasize the client’s safety as one of the reasons for pitching your product over the phone. By doing so, most prospects will appreciate your consideration for their wellbeing.

Tip #3 – Pacing Is Everything

There’s a lot more going on behind the scenes when you do business in person. Clients make judgments based on your interactions with them, your body language, eye contact, and so on.

But, with virtual sales, you don’t have these tools at your disposal. You have to instead rely upon the words you choose and how you speak.

In other words, tone and pacing are vital!

You cannot sound dull or uninterested in your product. And you must not rush. Pacing is everything, especially if your clients are mostly senior citizens.

There needs to be ups and downs in your tonality and pitch. There should be times when you speak in a staccato-like voice and times when you almost whisper certain points. Silence can also be a powerful tool.

This might feel more like acting than selling. However, it’s 100% necessary for success in selling insurance over the phone.

Tip #4 – Paint the Scene Visually

During virtual calls, you must describe your talking points as visually as possible.

I advise my agents to tell clients to, “Imagine this happening…” or “Picture this for a moment…”

You need to help clients visualize what you see to build value. It’s best to do this at natural times throughout your entire sales presentation.

Tip #5 – Tell Lots of Stories

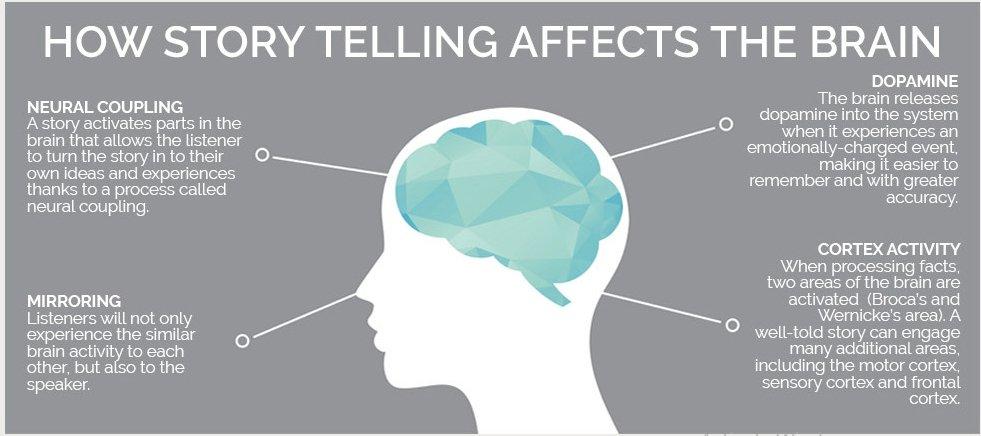

Building on Tip #4, you should use emotion to explain concepts rather than logic alone. This means embedding stories into your pitch.

Again, over the phone, agents lack certain advantages that come naturally during face-to-face sales. That’s why at my company, Buy Life Insurance For Burial, we emphasize the importance of telling stories to help convey urgency and clarify difficult concepts.

Stories are a sure-fire way to create more sales. Whenever you make an important point, relate it to the real world through actual experiences (stories). Then, clients will be more likely to understand why they need to buy insurance.

Tip #6 – Use Temperature Check Language

During your sales presentation, there will always be moments when you’re not 100% certain that your client has understood you. Perhaps they didn’t respond in the way you’d hoped, or they didn’t say anything at all and left you hanging.

In-person, it’s easier to detect when this happens. But over the phone, you need to use a different strategy.

If a concept takes longer than 10 seconds to explain, ask your client, “Does all this make sense?”

In other words, check with them before they lose focus. With any point that’s difficult to follow, ask, “Do you have any questions?”

By doing this, you’ll keep the focus on you. Don’t let your client get distracted by the TV or anything else while you’re explaining a critical point.

Tip #7 – Zoom or No Zoom?

A lot of insurance agents suggest using Zoom as a solution for virtual phone sales.

And of course, Zoom can be a great tool depending on the market. But, if you’re dealing mostly with senior citizens, I advise you to steer clear of Zoom calls. Technology can complicate the process, especially with older clients.

However, you’ve probably already guessed that this won’t be the case with younger generations who frequently use FaceTime, Skype, and other online platforms.

So, you’re more than welcome to utilize Zoom for this audience.

That said, don’t assume that Zoom alone is the solution to your virtual sales dilemma. You still need to work hard to build trust, rapport, and value.

Technology, by itself, isn’t the answer – you are. By adapting to the online tools you have at your disposal and using your skills as a salesperson, you can explain why your product is the right choice for your client. Never forget that!

And that concludes today’s article. I hope you’ve enjoyed reading and will take our Top Tips on board.

This is the greatest time ever to sell insurance. So, take action now! Don’t let a great opportunity pass you by.

You may also like: How to Protect Your Small Business During The Pandemic

You may also like: How to Create a BUsiness Continuity Plan

David Duford owns Buy Life Insurance For Burial, a virtual insurance agency helping seniors source quality final expense life insurance coverage. He is the author of 3 best-selling insurance sales and marketing books, including “The Official Guide To Selling Insurance For New Agents, “The Official Guide To Selling Final Expense Insurance,” and “Interviews With Top Producing Insurance Agents.” David is also a YouTube Influencer in insurance sales with nearly 17,000 subscribers and more than 1.7 million total views.